John Bleasby

The CHBA’s election wish list

Canadian ContractorAs a $125 billion player in Canada’s economy, CHBA members are a voice to be heard at election time

The Canadian Home Builders’ Association (CHBA) released a position paper regarding the Federal role in Canada’s residential building industry back in March, well before the Federal election call. It’s an excellent read, offering a timely challenge to all three major political parties to look at affordability of housing across Canada, which in turn affects how and where communities develop in this country.

Titled Continuing the Conversation about Homes, Communities and Canadians, the association’s concern is about affordability of housing and the impact on younger families. The question is: How to reduce non-construction costs, harmonise or nationalise regulations, cut red tape, and provide incentives for home savings, purchases and renovation?

Exponential costs increases from generation to generation

The CHBA makes the following opening point: “When today’s grandparents bought their first home, it cost them about three times their annual house-hold income… Now, for young families in many of our larger cities, that first home costs five, eight or ten times their household income.”

Read: Continuing the Conversation about Homes, Communities and Canadians

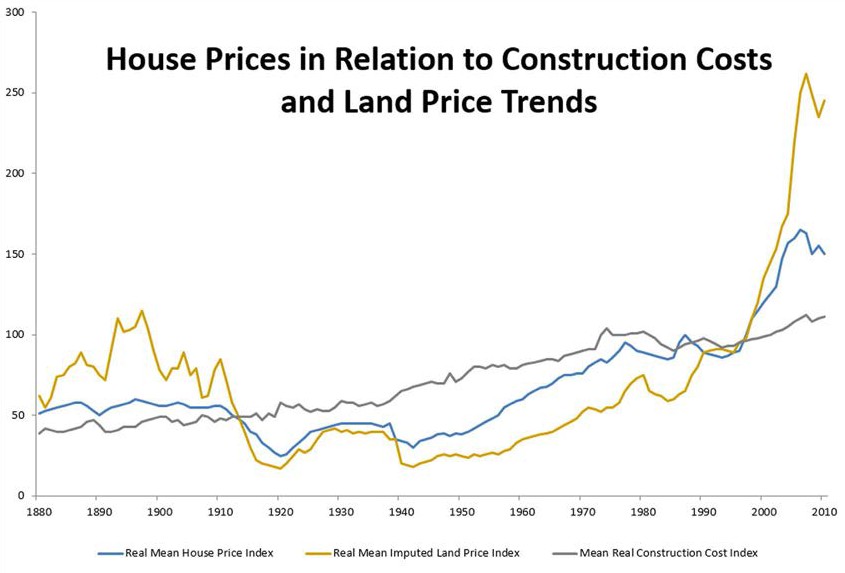

Source: K. Knoll, M. Schularick and T. Steger (2014): “No Price Like Home: Global

House Prices, 1870-2012.” Globalization and monetary Policy Working Paper No. 208

The CHBA believes that land costs, not construction costs, are currently driving up home prices more than any other single factor and well out of proportion to the actual value of the home itself. Most of these land cost increases are a result of two things:

1: Development charges by municipalities, often forced upon them by provinces, on new homes to fund lagging or outdated infrastructure in pre-existing communities.

2: The tax-on-tax result when HST is added to these multi-jurisdictional assessments.

Several recommendations from the industry to government

According to the CHBA, several other measures could be taken to make it easier to make that important first purchase of a home:

- * Longer amortization periods for qualified first-time buyers to 30 years

- * Indexing the First-Time Homebuyers’ Tax Credit

- * Raising the Homebuyers’ Plan limits, all of which would, in the CHBA opinion

Other recommendations include both taxation and regulatory changes, and tax incentives:

- * National harmonisation of codes, standards, trades qualifications and home performance labeling

- * An improved approach to development of the model National Building Code, and related standards and regulations to reduce red tape

- * Expanded home renovation incentive programs to combat underground “cash” operators

- * Assisting first-time homebuyers to renovate “fixer uppers”

- * Improving the energy efficiency of the housing stock

The CHBA platform makes the following strong statement about the importance of home ownership:

“Homeownership serves as the financial foundation for most families. Having homeownership slip beyond the reach of many well-educated, hard-working young people represents a huge change in Canada’s economic landscape.”

Some of the suggestions raised by the CHBA have come forward in statements made by at least two of the three main political parties during this election campaign. The vote is still weeks away; perhaps more will be said.

Leave a Reply