John Bleasby

Is HGTV ‘House Porn’ hurting first-time buyers?

Canadian ContractorCanada’s home renovation craze may be keeping young families out of the market

Fixer-upper TV shows are an HGTV juggernaut. It seems more are added each season, most following a predictable script:

“Don’t move! Remodel your current house instead, using a home equity line of credit if necessary, and watch your personal wealth soar!”

It’s more than just a TV scenario; it’s happening in the marketplace all across North America. The TV remodeling stars tease and titillate home owners with beautiful design concepts and endings complete with long-sought fulfillment. Some call it ‘House Porn’, and like the other varieties it results in unrealistic expectations followed by pangs of self-doubt and inadequacy. When the show is over, inevitably the viewer’s eyes pass over the room to their partner, perhaps with the plaintive cry “Honey, maybe we should try something different!”

Many shows follow the same story-line: Fix it up or sell it off?

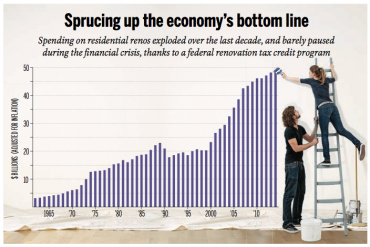

Of course, anything that encourages the renovation is good for the contracting industry…isn’t it? After all, an Altus survey shows renovation spending in Canada reached $68 billion in 2014, $20 billion more than was spent on new homes that year.

However, therein lies the issue: By renovating instead of moving, older homes are not made available to first-time homeowners, particularly in desirable inner cities. While the improvements usually increase the value of homes and likely address future family needs, it makes finding an affordable home increasingly difficult for younger families, most notably where resale prices are already soaring. A generation of potential home owners are being left behind.

How much more can Canadians afford to borrow?

Taking the plunge to buy a city home is an angst-riddled decision for first-timers. And it’s the same for current owners trading up; the cost of moving to a larger house is daunting, what with real estate commission charges added to legal and re-decorating costs. What if interest rates go up? Canadians are already heavily indebted, owing close to $1.63 for every discretionary dollar earned. Those choosing to renovate might worry that should the low interest rate party end, it would result in a dramatic drop in prices, thus reducing equity and cutting off the LOC funding pipe line.

Worse yet, what if interest rates go down? Real estate giant Royal LePage has expressed concern that further rate cuts might throw more gasoline on the country’s already red-hot housing markets and encourage current owners to double-down on home equity-funded renovations. It leads many to believe that something has to give, a concern that all contractors should monitor as part of their business strategies.

Is HGTV encouraging house porn?

Is HGTV encouraging house porn?

It’s possibly true, and the trend has shown no sign of a slowdown. It’s what some experts call the “HGTV effect”. Until the HGTV renovation shows hit the airwaves in 1999, most homeowners probably felt that, for example, their kitchens were just fine. But now, who could possibly imagine preparing a meal on anything less than stone countertops? The HGTV emphasis on cosmetic improvements often supersedes the real need for less glamorous maintenance or energy-efficiency improvements.

Superficial improvements do boost home values, at least that’s what many Canadians believe. A McLean’s magazine report referred to a survey conducted by a popular home-remodelling website claiming 60 per cent of Canadians cited “increasing value” as their key motivation, particularly when it was suggested to them that “$90,000 worth of renos to their tired bungalow just increased its “expected value” by—wait for it—$120,000.”

Where does it go from here?

Altus chief economist Peter Norman expects renovation spending to continue to grow over the next few years as the existing home inventory ages, thus requiring on-going maintenance let alone eye-catching renovations. As current homeowners renew their mortgages at ever-lower rates, it frees up cash-flow. Simultaneously, as home values increase even more money for renovation is available through home equity financing. So why move?

Of course, not everyone borrows to renovate. While estimates suggest only 20% of home equity loans are for home improvement, other surveys pin the number closer to 35%. In fact, cash payments (ie. the underground economy) for work less than $5,000, is an on-going concern for legitimate contractors.

Make hay while the sun shines!

Nevertheless, the desire for personal wealth creation via home improvement continues to be a driving force in Canada as the real estate market continues to buck the trends of other industries within the economy. No doubt it’s a great time to be in the contracting business: New homes are in demand in most parts of the country and renovation spending has never been higher. The sustainability of this cycle over the longer term is the question.

follow John on Twitter

@john_bleasby

Leave a Reply