John Bleasby

Major Edmonton residential builder enters receivership

Canadian ContractorReidBuilt Homes owed $64.6 million to bankers

ReidBuilt Homes, one of Edmonton’s largest and best known home builders, entered receivership this week owing $64.6 million to its bankers, leaving deposits paid by homeowners in limbo, and dozens of contractors and trades unpaid. An Edmonton judge approved an order allowing receivers Alvarez & Marsal Canada to take control and try to sort out the mess. Included are associated companies, such as ReidBuilt Homes Calgary, and Builder’s Direct Supply.

ReidBuilt traces its roots back to 1982 when it was formed by Arthur Reid. The company grew and expanded rapidly, with operations across Western Canada and the United States at one point. At its peak, ReidBuilt reportedly constructed as many as 500 homes a year.

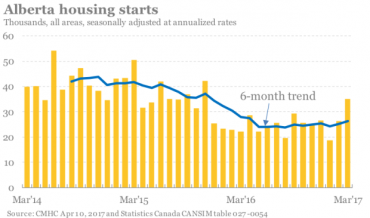

After a few turbulent years, the Alberta new home market was showing signs of recovery during 2017

Builders have been caught in Alberta’s market turbulence

Although lately showing some resiliency, the Alberta residential market has experienced up’s and down’s over the past several years, as oil industry fortunes have ebbed and flowed. Calgary in particular has been volatile, while Edmonton less so. With cash flow always an issue for builders, problems experienced by a geographically diversified builder like ReidBuilt in one market can have a domino effect on operations in other centres.

Where there was smoke, there was fire

Rumors of trouble started in the summer. Trades were asked by ReidBuilt to be patient when payment cheques were delayed. In early October, local media started reporting that the company was about to go bankrupt. This was immediately denied by ReidBuilt’s Calgary Sales and Marketing Manager Dave Abbey. “I’ve been advising all of our customers who have homes under construction right now that our head office in Edmonton is in the process of selling us,” he told local media, referring to the company’s Calgary operations. “I’m hoping by the end of the month there could be a buyer in place and they’re looking to close and turn over possession of the business by mid-November to mid-December.” Abbey continued, “Everything’s on the up and up but unfortunately people are talking and spreading rumors and a lot of these are rumors.” When the company failed to sell off its Calgary operations, those reported rumors became the actual truth; the bank pulled the plug a few weeks later.

At its peak, ReidBuilt Homes reportedly constructed over 500 homes annually across Western Canada and in the United States.

A devastating situation for dozens of trades and contractors owed payment

At that time, Abbey also said that homeowners would be protected by the Alberta New Home Warranty Program should any problems ever arise, both those who had taken possession and those whose homes were still under construction.

While this part of Abbey’s statement is true, there is unfortunately little recourse for contractors and trades owed money by ReidBuilt, Les Yochim, president of Edmonton-based Belvan Group of Companies Ltd., told Canadian Contractor. In fact, a number of contractors and trades owed money by ReidBuilt took to issuing liens back in mid-September against those who had recently taken possession of new homes. “Some of these trades had long term relationships with ReidBuilt,” said Yochim. However, Yochim downplayed any possible success by issuing liens. “Liens are really only good when the owner goes to sell the house,” he said, “and they have to be re-established regularly. The trades will be grasping at straws, trying to secure anything they can, knowing they’re not going to get full payment.”

Tighter credit is an immediate impact on other general contractors

Rather than opening up new opportunities for companies to fill a demand gap now that ReidBuilt has gone under, Yochim explained how the event will more likely have an immediate negative impact on general contractors in the area. “It makes some of our sub-trades a little more skeptical if a company like Reid can go down as quickly as they have,” he said. “Maybe payment terms are going to be tightened up a bit. We’ve had to ask some of your sub-trades for some leniency in the past; now they may be more hesitant to do that. There might be apprehension to offer credit. It creates a bit of uneasiness.”

Follow John on Instagram and on Twitter for notifications about his latest posts

![]()

Leave a Reply