John Bleasby

Western Canadian drywall prices to drop 32 per cent after tariff reductions

Canadian Contractor$12 million of tariffs previously collected will fund Fort McMurray’s rebuild and possible rebate programs

Federal Finance Minister Bill Morneau was in Fort McMurray, Alberta this week to officially announce much-anticipated tariff relief on U.S. drywall imports entering the Western Canadian market, reductions that will vary by product and manufacturer. However, the overall result is that imported drywall products should experience price reductions of more than 32 per cent. According to the Minister’s statement, the tariff reductions are intended “to maintain competitive conditions in the Western Canadian drywall market and reduce potential supply shortages, while ensuring a reasonable return on sales for domestic producers.”

Provisional tariffs, as high as 275 per cent on some products, were imposed in September 2016 by the Canadian Border Services Agency (CBSA) as a result of a complaint lodged by Certainteed Gypsum Canada (CTG), the sole gypsum board manufacturer in Canada’s West. CTG is a wholly-owned subsidiary of Saint-Goblin S.A. of France. The company had successfully demonstrated that a number of their American competitors had been selling drywall product into the Western market at prices below pricing available in the United States. Those actions fit the definition of ‘dumping’ under international law.

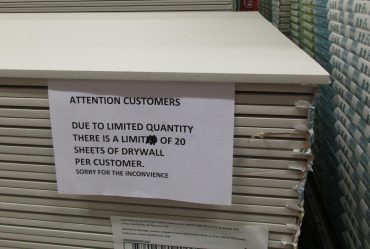

However, the high provisional duties caused immediate supply disruptions and soaring prices in Western Canada. Particularly sensitive to high prices and shortages has been Fort McMurray, Alberta, still reeling after devastating wild fires last spring. The Canadian International Trade Tribunal (CITT) deliberated in December 2016 to hear both support for and challenges to the tariffs, ultimately recommending reductions and relief programs in their January 2017 report.

However, the high provisional duties caused immediate supply disruptions and soaring prices in Western Canada. Particularly sensitive to high prices and shortages has been Fort McMurray, Alberta, still reeling after devastating wild fires last spring. The Canadian International Trade Tribunal (CITT) deliberated in December 2016 to hear both support for and challenges to the tariffs, ultimately recommending reductions and relief programs in their January 2017 report.

Fort McMurray, and perhaps builders and contractors to receive relief

In fact, the Minister promised that approximately $12 million of tariff revenue collected by the CBSA from September 2016 to January 2017 will be used to “provide specific monetary relief for Fort McMurray residents who are rebuilding their homes as a result of last year’s wildfires, as well as builders and contractors in Western Canada adversely affected by higher drywall costs.” No details were provided concerning how builders and contractors might receive their relief, although it may be via the Western Economic Diversification Canada starting in mid-2017. The CITT had recommended rebates to purchasers and a short-term tariff holiday as possible compensatory relief methods.

The tariff levels will vary, based on exporter behavior

The tariff levels will vary, based on exporter behavior

Also less clear is the exact amount of duty to be assessed on U.S. product going forward. David Barnabe of Finance Canada, told Canadian Contractor that under Canada’s trade remedy system, the amount of anti-dumping duty payable is equal to the difference between the “normal value” and the “export price”. Normal values had been calculated earlier by the CBSA during its anti-dumping investigation in the fall of 2016 based on the price of the good sold in the exporter’s home market or cost of production. Importers can in future avoid anti-dumping duties by importing goods that are priced at, or above, that normal value. At the same time, if exporters choose to drop their prices below those normal values, the tariff will be raised to compensate.

Prices will never return to previous levels

Although the promised 32 per cent reduction in drywall prices should be welcomed, prices will not be returning to pre-September 2016 levels. Canadian Contractor surveyed markets across Canada immediately after the provisional tariffs went into effect last fall and found that in three Western Canadian markets, prices of standard drywall (8’ x 4’ x ½”) had increased by as much as 80 per cent. A reduction of 32 per cent from those levels will still leave prices more than 20 per cent higher than before.

The CHBA is pleased. Certainteed Gypsum Canada and union workers maybe not so much

Nevertheless, the Canadian Home Builders’ Association (CHBA) was quick to praise the announcement. “Through an unprecedented accelerated inquiry, and with its announcement today, the government recognized that the imposition of the original drywall duties, which were at exorbitant levels, was contrary to Canada’s economic, trade and commercial interests,” said Kevin Lee, CHBA CEO. “Our Association and its members commend Minister Morneau and the government for taking expeditious action with respect to the cost impact of the duties on the actual users of drywall.”

However, both CTG and the union representing their workers had argued at the CITT hearings in December 2016 that any tariff reductions would put CTG’s Western Canadian operation at risk and potentially cost union workers their jobs. However, the CITT ruled that continued high tariffs were in fact giving the company both an unfair competitive advantage and a level of profitability higher than any other similar operation in the Saint-Gobain’s global operations.

Follow John on Instagram and on Twitter for notifications about our newest posts

Advertisement

Print this page

3 Comments » for Western Canadian drywall prices to drop 32 per cent after tariff reductions

1 Pings/Trackbacks for "Western Canadian drywall prices to drop 32 per cent after tariff reductions"

-

[…] There was the recent drywall tariff Canada imposed, that came at the worst possible time for rebuilding efforts in Fort McMurray. There was the iPod tax that was inadvertently added into the federal budget a few years […]

Point of clarification; CGC is not Certain Teed Gypsum, it is Canadian Gypsum Corporation (owned by USG) as reported incorrectly in this article. Much of the information coming out of the Finance Minister’s office is vague and gives the impression that prices will be coming down. That may not be true as there appears to be issues with the valuation methodology to set the base value which the 32% reduction will be applied to. Initially it appears prices may actually go up, which could result in at least one manufacturer exiting the Western Canadian market which would result in severe shortages of drywall to handle the demand. Additionally it appears the Finance Minister’s Office completely ignored the lengthy Trade Tribunal recommending a 43% tariff which would have been better than this result. This is not a good decision for Western Canadians. Definitely not one in which the Finance Minister should be praised. Actually, the opposite is true.

Tim: Thanks for your comments. I stand corrected on the CTG/CGC mix-up. Now corrected.

I agree with you about the vagueness of the Minister’s statement, particularly as it relates to possible rebates to customers during the Sept-Jan period. I will be following developments as any programs unrolled by Western Economic Diversification Canada are announced. As far the tariff calculation formula goes, you may be right; a simple tariff of 43% would be easier to understand. However, that apparently is not how anti-dumping rulings go. As explained to me by Finance Canada and outlined in the article, a historic ‘normal’ price has been established based on historical research of imports over a few years. Variants up or down from that ‘normal’ price will impact tariffs up or down in order to keep the landed price on a par with the past, prior to the dumping behavior. As stated by the Minister, Finance Canada expects prices to drop 32% AT THE BORDER (32.17% to be exact). Of course, they cannot tell wholesalers and retailers how to price the product. I am now tracking prices in Western Canada in a manner similar to that throughout the fall and will be noting any movements over the next few weeks.

Still waiting to see that drop in price. April 2018 and still 13 dollars a sheet. Funny thing, its 10 dollars a sheet in Ontario. Time to punt the Liberal government.