By Graham Smith, OAA

Building on the dip: an architect’s opinion

Canadian Contractor Financials Project ManagementI like recessions…rarely will you hear architects and builders utter that phrase. I like recessions because they are the best and easiest times to get projects built.

In October 2007, the markets began their 17-month sub-prime collapse. By September 2008 the market had lost over 20 per cent of its value…and then things really got bad. In the first week of October 2008, the Dow lost another 18 per cent.

On Monday, October 13th, I had a pre-demolition meeting with Toronto clients for whom we were building a new house. My first words to the clients that morning were “Are you sure you want to go through with this, demolishing a perfectly good house during this financial crisis?”.

Their calm response was that she was a Teacher, he was a Doctor, their investments were tied up in long-term RRSPs and mortgage rates were close to all-time lows (they were approved at 5.1 per cent). But the two sentences that stick with me to this day were “Everyone else is panicking and we think we’re going to get some really good deals and save some money. Our budget is going to go a lot further!”

They were right. Lumber, drywall, insulation, steel, copper, concrete, glass…every commodity dropped in price and just about anything made from them did too. Material prices dropped anywhere from five to 30 per cent and labour prices, while not dropping that much became much more competitive. Fixtures, finishes and equipment (FF&E) could all be found on sale.

We saw this same kind of opportunity in the late 80’s, the Dot-Com bust of 2000 and for a brief period of uncertainty in 2015/16. Yes, these are all related to stock market movements, but that’s because they happen to be the most prevalent economic numbers in our daily lives. The Consumer Confidence Index in Canada mirrors these peaks and troughs…however the Canadian housing market has not.

So what’s it going to be this time around? Since the dip of 2016 our business of designing and building custom homes and cottages has been very busy. Though we are not diversified in what we do our clients are and in the 25 years we’ve been in business we have discovered that we are recession-proof because the smart money builds during recessions.

Since the pandemic was declared in the spring of 2020 it has been downright chaotic, busy, but in all the wrong ways. When the pandemic began, rather than the housing construction market grinding to a halt along with everything else, it went in completely the opposite direction. Residential design and construction was deemed an “essential service” and projects moved forward, albeit at a snail’s pace.

Working from home gave “home” a whole new meaning. Millennials upsized from their Toronto condo’s and moved to the suburbs and beyond to work remotely. Families upgraded to bigger rear yards and cottage properties. Builders couldn’t keep up and also couldn’t find a price threshold that was “too much”, prices skyrocketed and everyone was renovating something.

With nowhere to go and not much to do, the last three years have seen homeowners in Canada cooped up, working hard and investing in their homes, largely driven by the lowest consumer interest rates in modern history and unparalleled Government spending.

However, strong consumer demand, combined with global supply chain and manufacturing issues caused steep price increases in materials and FF&E. Russia’s invasion of Ukraine only made matters worse by increasing energy prices and kicking inflation into high gear.

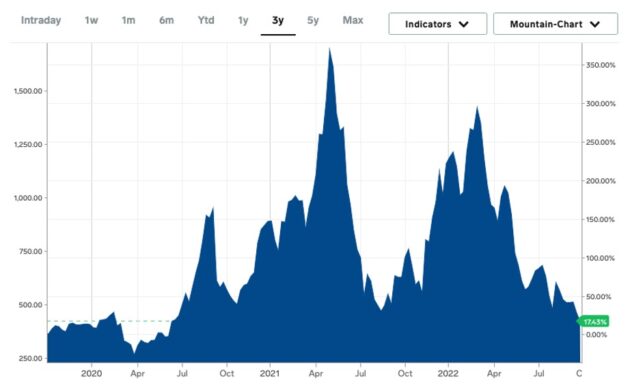

The commodity price of softwood lumber (above) is a good indicator of activity in the broader North American housing market. In February 2020, the spot price was $460 and by the beginning of April, after the pandemic was declared, it had dropped to $265. Then the wild ride began. Caused by mill closures and weather events (B.C.) and unexpected consumer demand the spot price rose to $950 in September of 2020, falling back to $500 in October before its meteoric rise to an all-time high of $1670 in May 2021. From that high it fell back to $470 in August, then back up to $1420 by March 2022. From last spring to now it has fallen back to where it was before the pandemic began at $430. To put this into perspective, the wholesale price of plywood, the source of many great pandemic jokes, has dropped 75 per cent over the past six months.

Building in this turmoil has made accurate budget forecasting nearly impossible nor can we rely on our own historic quoting data because labour prices to are at an all-time high while material prices fluctuate from one month to the next.

However, I feel we are at the very beginning of normalization in the custom housing market…and it’s just that, a feeling. This is not to be confused with the broader housing market and the shortage that has created a feeding frenzy for homes over the past decade. What we are discussing here are one-off custom homes.

So what do I mean by normal? Normal is:

- Being able to rely on the price of everything from one month to the next.

- Being able to get multiple quotes from trades and have them be reasonable.

- Being able to schedule labour weeks and months ahead instead of months and years ahead of when needed.

- Being able to get materials and FF&E weeks and months ahead instead of months and years ahead of when needed.

- Being able to order something, anything, with one phone call instead of ten.

- Being able to put together a budget and have it be relevant throughout the course of the project.

Are we there yet? Definitely not, but the signs are there when we look at housing and housing-related purchases. In no particular order here’s why I think prices, particularly material prices, are going to head into a trough going into 2023:

- Consumers are up to their eyeballs in debt and low-interest Home Equity Lines of Credit (HELOCs) are to blame. Recent interest rate hikes have effectively tripled the cost of servicing that debt. This is going curb spending as consumers have less free cash flow and a severely reduced appetite to borrow.

- Interest rate hikes have also disqualified a vast number of Canadians from buying homes and have put them on the sidelines waiting for prices to fall, which they are, 10-25 per cent depending on what stats you look at. According to the Canadian Real Estate Association, annual residential sales activity in Canada has dropped from a quarterly adjusted high of 750,000 units in the first quarter of 2021 down to less than 450,000 in August of 2022. That’s 40 per cent less potential new-builds, kitchen and bathroom renovations and backyard landscaping.

- Even with the current correction underway, Canadian home prices have risen 300-400 per cent in 20 years outpacing Canadian core inflation which only rose 51 per cent over the same period. Consumers are spending too much to buy a home and few have money left to renovate or remodel. During the pandemic everyone who wanted to take on a project did and that is tapering down as the ability of homeowners to collateralize their homes to borrow has significantly tightened.

- As housing prices spiked during the pandemic, rebuilds, renovations, remodels and additions were seen as enhancing an appreciating asset, the same can not be said in a falling market if homes had been purchased over the past five to 10 years. A large swath of the Canadian market is worried about their homes being in or near a negative equity position if the market continues to correct.

- Global supply chains, shipping cost and inventories are returning to normal albeit slowly. No empty shelves in Home Depot.

- Unless it needs a semiconductor chip, order back-logs are starting to be reduced or eliminated and in some cases, items that we couldn’t get our hands on a year ago are starting to go on sale as manufacturers and retailers are watching order bookings dry up.

- Commodity prices for the building industry have been falling consistently since the spring of 2022. Some have fallen precipitously to at or below pre-pandemic levels such as lumber products while others like steel still have a way to fall.

So what does this all mean? In a nutshell, if you’re looking to build be ready. I wouldn’t advocate starting a building project right now, however six months from now may be a totally different situation. We are advising clients to get approvals and building permits, prepare budgets and be ready to start when the right opportunity presents.

Markets hate uncertainty, the post-pandemic world is full of it and Russia’s war in Ukraine pushed it over the edge. When the markets are uncertain consumers tend to go along for the ride, spending patterns change and/or grind to a halt. We have seen it before, though this time may be different, because the peak is very high and we are in uncharted waters.

Conventional wisdom says that it’s impossible to time the bottom of the stock market or any market for that matter. However it is possible to look at a longer period of market activity and decide whether it’s the right time to buy or sell, we may still get it wrong but there’s a better chance of getting it right. The saying “those who do not learn from history are doomed to repeat it” is applicable, while history never repeats itself historical events often bear semblance to one another.

Dips in the building market that have occurred in the past rarely last more than a year and sometimes only a few quarters, before demand rebounds and prices return to long-term averages. I have no doubt that we are at the beginning of a dip, the question is how far will it go? Does “the bigger they are, the harder they fall” apply this time round? I don’t know, nobody does. For those with money in the bank, be ready to spend when the opportunity for a good deal presents itself because it will be just that.

However, the next question that needs to be answered is should clients who need to borrow think any differently than those that don’t? I believe the answer is no because climbing interest rates shouldn’t be the deciding factor unless of course, they become unaffordable.

The Bank of Canada’s interest rate has hovered between 0.25 per cent and six per cent since the mid-nineties. All things considered, very manageable for most homeowners. At the current rate of 3.75 per cent, not seen since before 2008, and a rate hike still likely in the forecast, five-year fixed mortgage rates will likely hit six per cent which is still close to the lowest they have been in half a century.

Are rates going to spike? Unlikely, because we are unlikely to see the inflationary conditions that Fed Chairman Volker faced in the 80’s or the methods he employed to tame it but more likely because consumers, businesses and most importantly the Government, at all levels, are already at debt levels that would be difficult to sustain and the Central Banks know it. As long as core inflation is softening, because people’s wallets have already taken a hit, market sentiment is that central banks are going to be overly careful not to overcorrect with rate hikes and send the economy into a deep recession.

So with the fear of 1980’s mortgage rates off the table, what’s a more reasonable prediction? Likely the same as what happened after the sub-prime crisis when rates peaked at about six per cent and then settled down into the three per cent range for most of the last decade. Mortgage rates did the same thing after the Dotcom crash albeit starting at 8.5 per cent before settling down into the six per cent range for the best part of a decade.

So for those that need to borrow to build their new home or cottage, should they wait for rates to come down and risk missing building on the dip, the answer is a resounding no because the savings more than offset the extra interest that may be incurred over the next few years.

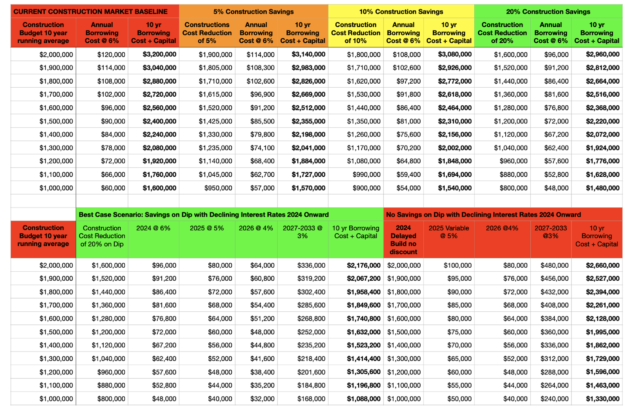

The above spreadsheet demonstrates the impact that savings of five per cent, 10 per cent or 20 per cent can have on building projects with budgets from $1 million to $2 million. The top set of numbers assumes that mortgage rates stay at six per cent every year for a decade and only interest is paid, no capital. Quite simply it demonstrates the difference over a ten-year period of achieving savings of five per cent, 10 per cent or 20 per cent if such savings are achieved in year one.

The green set of numbers on the bottom half of the sheet represents an unlikely but not entirely implausible situation. In this scenario, the big dip occurs in 2023 which results in 20 per cent savings while fixed mortgage rates remain at six per cent until the end of 2024 and taper down to three per cent for the remainder of the decade.

The next set in red represents the exact same scenario except that the owner delays the project for a year due to “uncertainty” and misses the dip entirely. The difference in interest-only costs over 10 years is dramatic.

All things being equal missing the dip is an expensive mistake. Will it come in 2023? Who knows but be ready for it when it does.

_________________________________________________________________________________________

Graham Smith is an architect and construction manager that has been designing and building high-end homes and cottages in Ontario since 1995.

Leave a Reply