Daniel Reale-Chin

CREA updates resale housing market forecast

Canadian Contractor Canadian housing housing affordability real estateThe Canadian Real Estate Association now forecasts a decline in national home price and purchases in 2023, with a turnaround going into 2024.

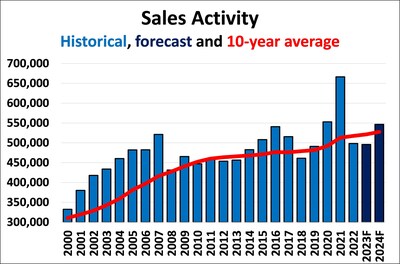

Sales activity, historical, forecast and 10-year average (CNW Group/Canadian Real Estate Association)

The Canadian Real Estate Association (CREA) is predicting a 5.9 per cent decline in the national average home price this year, in the association’s updated Canadian real estate forecast for 2023 and 2024. The forecast predicts home sales activity using the Multiple Listing Service (MLS) systems of Canadian real estate boards and associations.

Around 495,858 properties are forecast to trade hands on Canadian MLS systems in 2023, a 0.5 per cent decline from 2022. The report also predicts that the national average home price is forecast to decline 5.9 per cent on an annual basis to $662,103 in 2023.

“It’s important to note that based on the monthly data under the surface, that decline has already happened over the course in 2022; however, the record setting start to that year will be reflected as a decline this year as prices are not expected to be anywhere near those record levels in 2023,” reads a press release from the CREA.

National home sales are forecast to rise by 10.2 per cent to 546,625 units in 2024, still below the 2020 and 2021 figures. The national average home price is forecast to recover by a moderate 3.5 per cent from 2023 to 2024 to around $685,056, below 2022 but back on par with 2021.

Housing prices are still mixed across Canada, but on a province basis, the association reports that prices have mostly cooled from their peaks in markets within Ontario and British Columbia. Home prices in Alberta, Saskatchewan and Newfoundland and Labrador have held steady, according to the report, while Quebec and the Maritime provinces land in between.

The association predicts it will likely remain quite difficult for many first-time buyers to enter the housing market until mortgage rates are lower than they are today. Yet, the association expects some buyers to come off the sidelines once they have more certainty that rates have topped out.

Leave a Reply