John Bleasby

BuildForce report is an industry roadmap for the next 10 years

Canadian ContractorNo forecast is perfect but this one contains a wealth of labor demand information

Say what you like about weather forecasters and stock market analysts; they may not hit the nail on the head each time when it comes to predicting the future, but could you really survive without them? For home builders and renovators, one of the best sources for gaining an understanding of the factors impacting the industry’s future is BuildForce Canada.

Who is BuildForce?

Originally named the Construction Sector Council back in 2001, BuildForce today describes itself as, “a national industry-led organization committed to working with the construction industry to provide information and resources to assist with its management of workforce requirements.” As such, it monitors dozens of trade organizations all across the country and related housing data, measuring in particular the ebbs and flows of labour demand and the factors that can cause changes over time. It thus provides critical forward-looking information for the construction industry.

Labour requirements are key to the future of construction

BuildForce’s March 2017 report focusses on the anticipated labour requirements in Canada’s residential construction industry from 2017 to 2026. What is interesting is that despite the report’s prediction of slower growth in the industry overall, the future demand for workers needed to replace those reaching retirement age will make the search for new talent all the more important for contractors and builders hoping to thrive into the next decade.

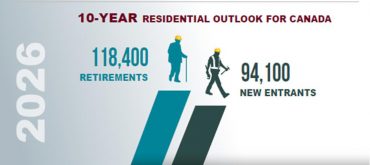

Although the overall labor pool is projected to be smaller over the next 10 years, there will be a big demand for new entrants to replace retiring workers. (BuildForce graphic)

Specifically the report states, “New workers will be required in residential construction over the 2017–2026 scenario… driven by the need to address an aging workforce, where an estimated 118,400 residential construction workers are expected to retire over the next decade. This represents a significant loss of skilled workers. Replenishing exiting workers may become increasingly difficult with slower population growth and fewer young people available to enter the workforce.”

Slower new housing growth predicted over the next 10 years

The BuildForce reports also suggests that the slower growth in the residential industry will mean fewer jobs required overall, a decline in employment of over 37,000 or seven per cent from current levels. While that may appear to show weakness, that would be, in the reports’ opinion, a false impression; over 94,000 new entrants will be required to fill the gap created by retirees, despite any slowdown in construction activity.

Residential construction and renovation is a $124 billion industry in Canada (BuildForce graphic)

Provincial variances must be taken into account

Not surprisingly, individual provinces can expect varying degrees of housing demand given different economic outlooks and sensitivities across the entire country. For example, the report suggests, “Alberta, Manitoba, New Brunswick and Prince Edward Island [will] go through a moderate up-cycle that will drive housing starts and employment up and then down, as demographic trends limit growth over the long term,” whereas weaker predicted population growth impacting British Columbia, Quebec, Nova Scotia and Newfoundland and Labrador will result in lower new housing activity over the 2017-2026 period. Ontario and Saskatchewan, however, can expect housing activity to be sustained near current levels.

Renovation could be the key to in those provinces that experience a decline in new home construction. “Moderate, but steady, increases in renovation and maintenance activity partially offset the expected decline in new residential activity,” the report says. What is striking from the figures compiled by BuildForce is the not only the size of the residential housing industry overall, but indications that renovation and new construction are almost equal size in dollar terms. Clearly renovation is not a sector to be underestimated in terms of future consumer demand.

Where will the new workers come from?

Where will the new workers come from?

Maintaining a skilled work force will require a concerted effort by contractors over the next 10 years. “The industry will need to remain focused on efforts related to recruiting, training and retaining young workers.” the report says, “Slower population growth means less young people available to enter the workforce, which has the long-term effect of driving unemployment down and leaving a limited pool of local workers. Residential construction will also be competing against other industries that are facing similar demographic challenges. Recruiting efforts will need to increase initiatives to engage underrepresented supply sources, including women and Indigenous people, and target new entrants from local sources of labor, new immigrants and workers from other industries to meet residential construction’s long-term needs.”

BuildForce’s 32 page report is available on line and provides remarkable detail on the specific trades under pressure to find new workers, broken down into provincial scenarios. It’s a good read for contractor wishing to strategize their future.

Talk to us!

Are you taking steps to actively attract and recruit new sources of labor to your company??

Please comment below, or email in confidence to

jbleasby@canadiancontractor.ca

Follow John on Instagram and on Twitter for notifications about his newest posts

Leave a Reply