John Bleasby

Federal budget pulls back from a full small business tax assault

Canadian ContractorIt's more a punch in the nose than two broken legs

It could have been worse. The 2018 Federal Budget backed down from some of the most controversial tax proposals suggested last year. Instead, the Liberals focussed on the taxation of passive investment income within corporations. They also confirmed that the small business tax rate will drop, from 10.5 per cent currently down to 10 per cent effective January 1, 2018, and down to 9 per cent effective January 1, 2019.

What is passive business income and why is it under attack?

Passive income is the income earned from a corporation’s retained earnings. In addition to corporate tax rates on earned income that are generally lower than the personal tax rate, many companies hang on to their earnings rather than paying them out as salary, dividends, or bonuses. This gives the company the financial flexibility to survive short-term business turndowns, to fund new equipment, to expand the business, and sometimes to help with the owners’ retirement planning. The intention has been to assist companies that might have difficulty raising necessary capital, a provision that has been in place for nearly 45 years. Small businesses enjoy an even lower rate than the general corporate rate, making it very advantageous to hold investments under a corporation’s name.

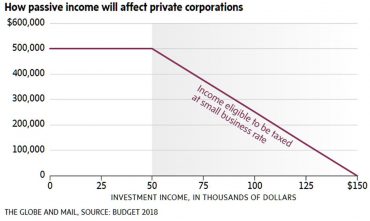

The tax rate on passive investment income will increase after $50,000 per year to the general business tax rate at $150,000 per year

However, the current Liberal government signaled last summer that it considers this low taxation rate for passive income as unfair to “ordinary Canadians”, citing the ability of wealthy business owners to ”game the tax system” by developing low-tax investment portfolios within a corporation rather than holding them personally.

Therefore, starting in tax years after January 1, 2018, the amount that a company’s passive income can enjoy the lowest rate will be capped at $50,000 per year. Beyond that, the tax rate advantage on passive income slopes up to the regular 15 per cent corporate tax level as it approaches $150,000 per year. Earlier investments will not be grandfathered, however, as had been hoped. The Liberals believe that this change will only impact the wealthiest three per cent of Canadian corporations.

Vaguely positive noises from the CFIB

The Canadian Federation of Independent Business (CFIB) gave some credit to the government for not attacking the passive income issue as strongly as first feared, but was less than enthusiastic about the longer term impact. “While we compliment the government for rethinking its plans for taxing passive investments, it remains to be seen how significant this improvement will be,” said CFIB President Dan Kelly. “The new rules appear to be simpler and may improve things for some business owners from the earlier proposals, but others will lose the benefit of the lower small business rate due to past investments.”

A billion-dollar boost for Ottawa

Combined with previously announced changes to reduce the practice of income sprinkling —paying salaries to family members in order to reduce the overall personal tax burden — the federal government expects an overall revenue boost for Ottawa close to $1 billion, an estimate the CFIB calls a “billion-dollar take-away from entrepreneurs.”

Other changes that impact refunds payable on dividends paid were also included in the budget. However, given the complexity of the entire issue, business owners are advised to contact their tax professions for guidance.

What’s with Joan the Plumber?

Much of the budget focussed on gender equality issues, a seemingly critical issue for the Liberals in Ottawa. While the announced programs will likely have limited impact on the residential construction and renovation industry, Finance Minister Bill Morneau took the opportunity to engage in a rather curious bit of storytelling.

“We believe that Canada’s future success rests on making sure that every Canadian has an opportunity to work, and to earn a good living from that work,” he told the House. “And that includes Canada’s talented, ambitious, and hard-working women. I want to tell you a story, Mr. Speaker, about one such woman. Her name is Joan.”

Morneau went on to describe how this Joan returned to College to study event planning, discovered her true calling as a plumber, and went on to a skilled trades career that now supports her family. “I mention that story,” Morneau continued, “because it’s people like Joan — people who have the courage to try new things and to forge new paths — who make our economy strong, and guarantee its future.”

This reference to Joan the Plumber is reminiscent of John McCain’s famously flawed U.S. presidential campaign 10 years ago. Remember, “Joe the Plumber”? Joan’s story is lovely, and one that relates to the serious skilled trades shortage felt across Canada. Sadly it was used simply as a convenient prop for the Liberal’s social engineering platform and not related to any new funding to address trade shortages through expanded programs. For that, we’ll have to wait for another federal budget.

Got feedback? Make your opinion count by using the comment section below,

or by sending an email to:

JBleasby@canadiancontractor.ca

Follow John on Instagram and on Twitter for notifications about his latest posts

![]()

Advertisement

Print this page

Do you have any specifics on how the government intends to interpret income sprinkling.

ex: If a spouse does the books of a small construction business, deals with all the IS issues and the digital marketing including communication and selection of who to deal with; Homestars, Renovation Find, Get Assist, BBB and a host of others that regularly pop up every month it seems.

Surely there has to be some kind of test that the government will use to approve the work that a spouse does and contributes to the business success when issued a T4 for the past 4 or 5 years.

Or do they just intend to roll the spouse`’s income into the larger income of the husband “on the assumption that no spouse does legitimate contribution to the business”?

Bob

Hi Bob,

Here’s an article that might help you understand.

http://business.financialpost.com/personal-finance/taxes/what-the-proposed-new-income-sprinkling-rules-mean-for-you-and-your-business

JB