John Bleasby

Is the sun rising or setting on small scale residential solar?

Canadian ContractorWhat happens to financial viability as installation grants and big subsidies disappear?

Contributing Editor John Bleasby wanted to explore the financial viability of installing a PV solar array on his rooftop. After a thorough analysis, he concluded the numbers didn’t add up.

The Net Zero Energy concept says a house should produce at least as much energy as it uses. It’s the third column of NZE support that includes a tight building envelope and internal air management. In terms of power generation to offset power use, the installation of PV solar arrays on a home’s rooftop has been the popular choice. Provincial grants for installation, plus generous buy-back contract programs for the power generated, has spawned a vibrant, growing industry over the past ten years. Media attention has coupled the importance of doing “the right thing for the environment” with a strong financial argument. Some homeowners are actually making tidy profits from their solar installations. For example, early adopters to Ontario’s MicroFit program (now cancelled) were given 20 year contracts that will pay them over $0.80/kWh for power that the provincial utility resells for $0.15/kWh or less.

But times have changed. Power generated from renewable sources of all kinds, including industrial-sized wind and solar farms, have contributed to an electricity surplus in many parts of the world, forcing wholesale prices lower and lower. The result is little incentive for governments to subsidize new residential solar installations or to pay homeowners enormous premiums for the power they generate.

So what happens now? All good conscience aside, does it make financial sense to install a PV solar array on a home today? To find out, I decided to analyse my own house, comparing my actual electricity usage over 12 months with the power a PV solar array on my rooftop might generate.

My House: A brief outline

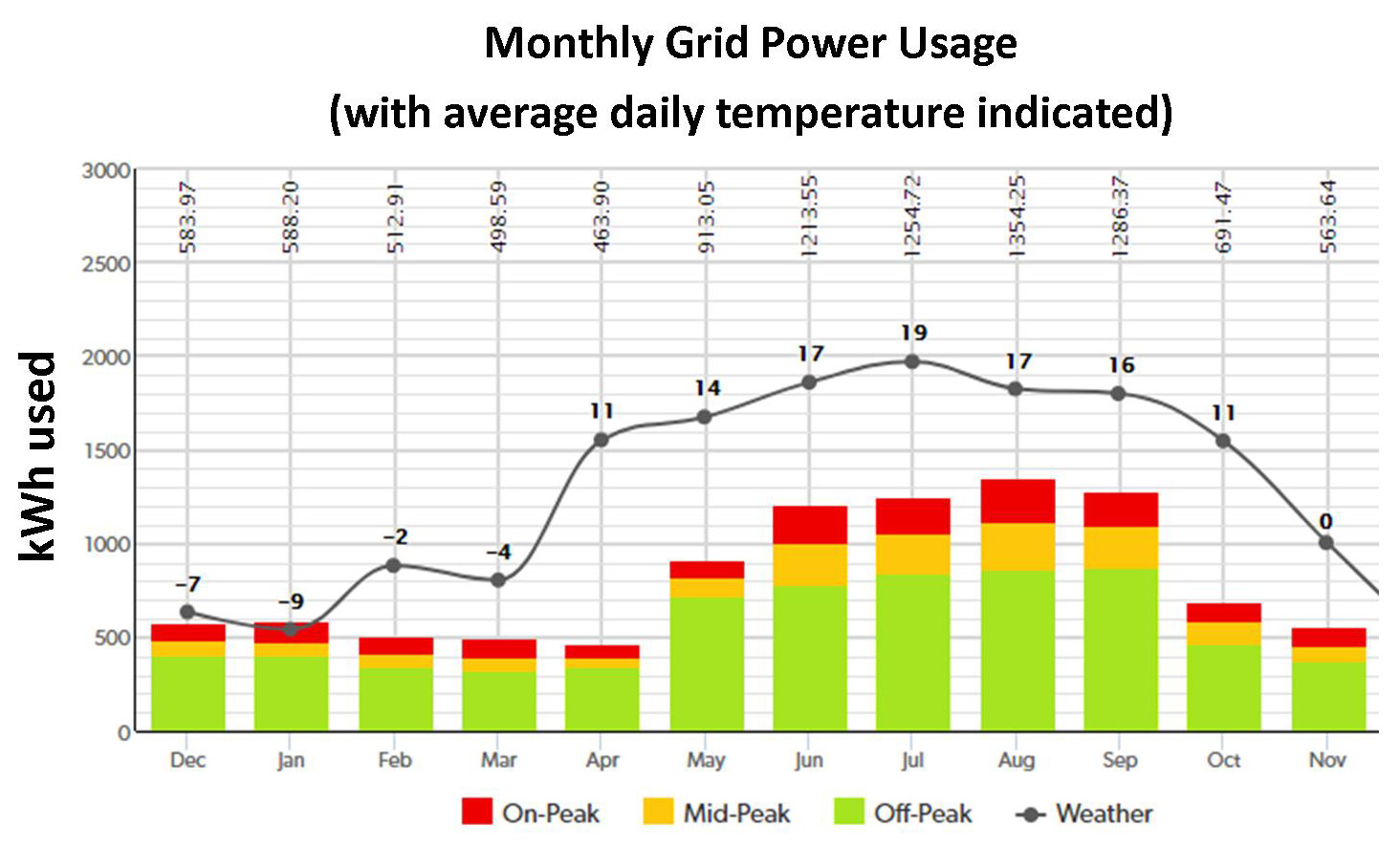

My wife and I live in a three year old house two hours north of Toronto, a modern 3-bedroom design on two levels. In all, there’s over 3200 square feet. The foundation and walls are ICF, right to the roof. The underside of the roof deck is insulated with spray foam. There’s low-E glass and LED lighting throughout. We have a high-efficiency forced air natural gas furnace coupled with an air conditioner. We have a natural gas water heater, cook-top and fireplace. There is also a 40 foot swimming pool that, although unheated, requires the filtration system to run 24/7 for four months. In summary, the house is extremely well insulated and energy efficient, despite the luxury of a pool. It’s an efficient house with relatively low electricity usage, as the chart below indicates.

My power utility shows me how much monthly grid power I use, and when. Note the summertime peak due to the swimming pool and occasional air conditioning (graphic: My Hydro)

Step One: What could I expect from a PV array on my roof?

To design a hypothetical PV array system, I used software developed for the National Laboratory of the U.S. Department of Energy called PVWatts Calculator. According to its website, PVWatts allows homeowners throughout the world to estimate the production and cost of grid-connected PV energy based on their location, and local 12-month historic weather and sunshine patterns. The software found my house using Google Maps and let me outline the perimeter of a PV array on my roof. It then indicated that an 11kWh system would fit, and calculated how much power that system would generate based on historic data of sun and weather. I then used data available from my power utility, and compared the two sets of data over a full 12-month period. I did not include debt retirement, account and delivery charges levied each month — they are a constant now and in the future.

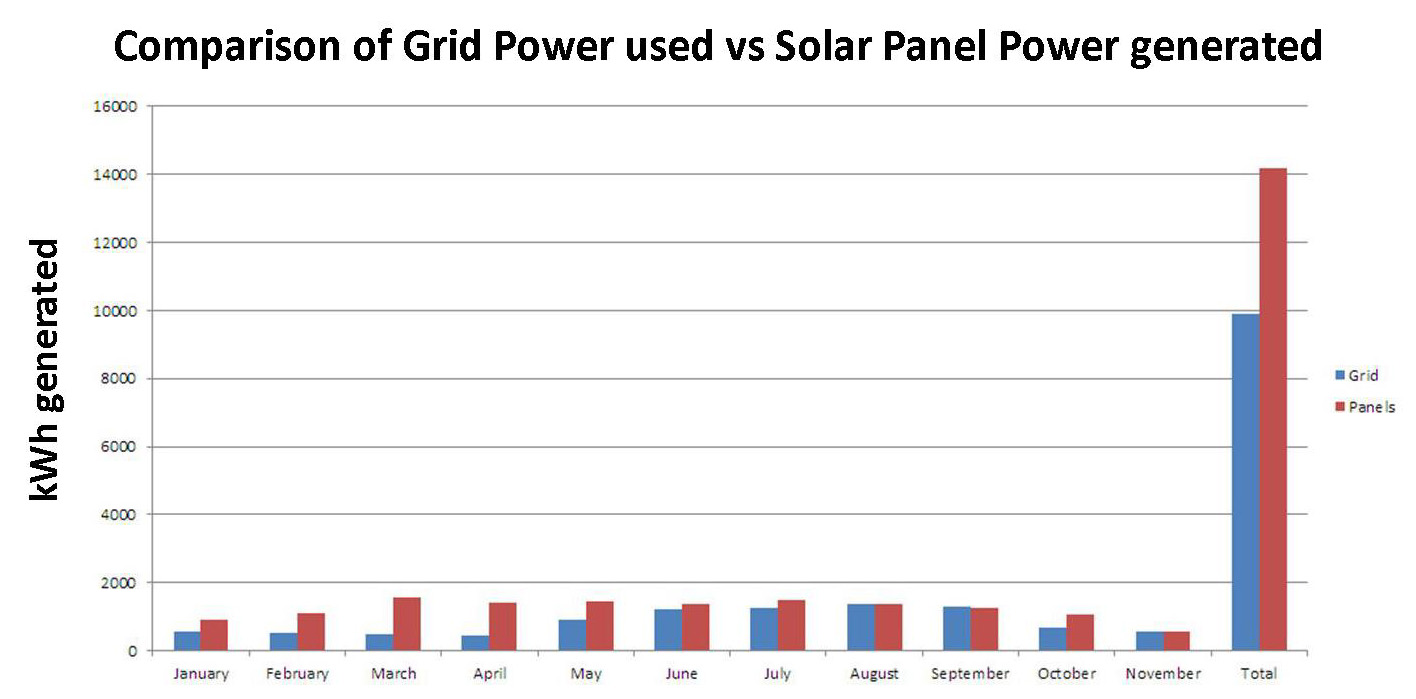

As the graph below shows, given my current low usage of electricity, the PV array would generate more power than my home needs, almost every month of the year. In fact, by the end of the year, I would generate a surplus of 4,315 kWh.

My hypothetical PV array will generate a surplus of power almost every month of the year, and a large annual surplus at the end of 12 months (graphic: John Bleasby)

I then looked at the actual cost of the electricity I used over the past 12 months versus the value of the electricity my hypothetical array would generate. The surplus value was $442 at current rates. However, it’s important to understand that under net metering programs across the country, most utilities will not pay for any surplus. They ‘zero-balance’ any surplus generated over 12 months and start again the next year, or charge the going rate if more power is used than generated. In other words, I have to use it or lose it. That’s the heart of the issue.

What to do with my surplus power?

Since the value of my surplus is pretty small, so investing significant new capital to replace my natural gas heating system, for example, would be a poor decision. I could possibly switch to an electric water heater, but it’s less efficient than gas. Maybe I could buy an electric car and charge it at home. However, my rural location conflicts with the range limitations of most electric vehicles. Perhaps I could add a storage battery system to take advantage of off-peak utility power costs and to store my surplus power. However, as the chart above indicates, we’re already quite good at taking advantage of off-peak rates.

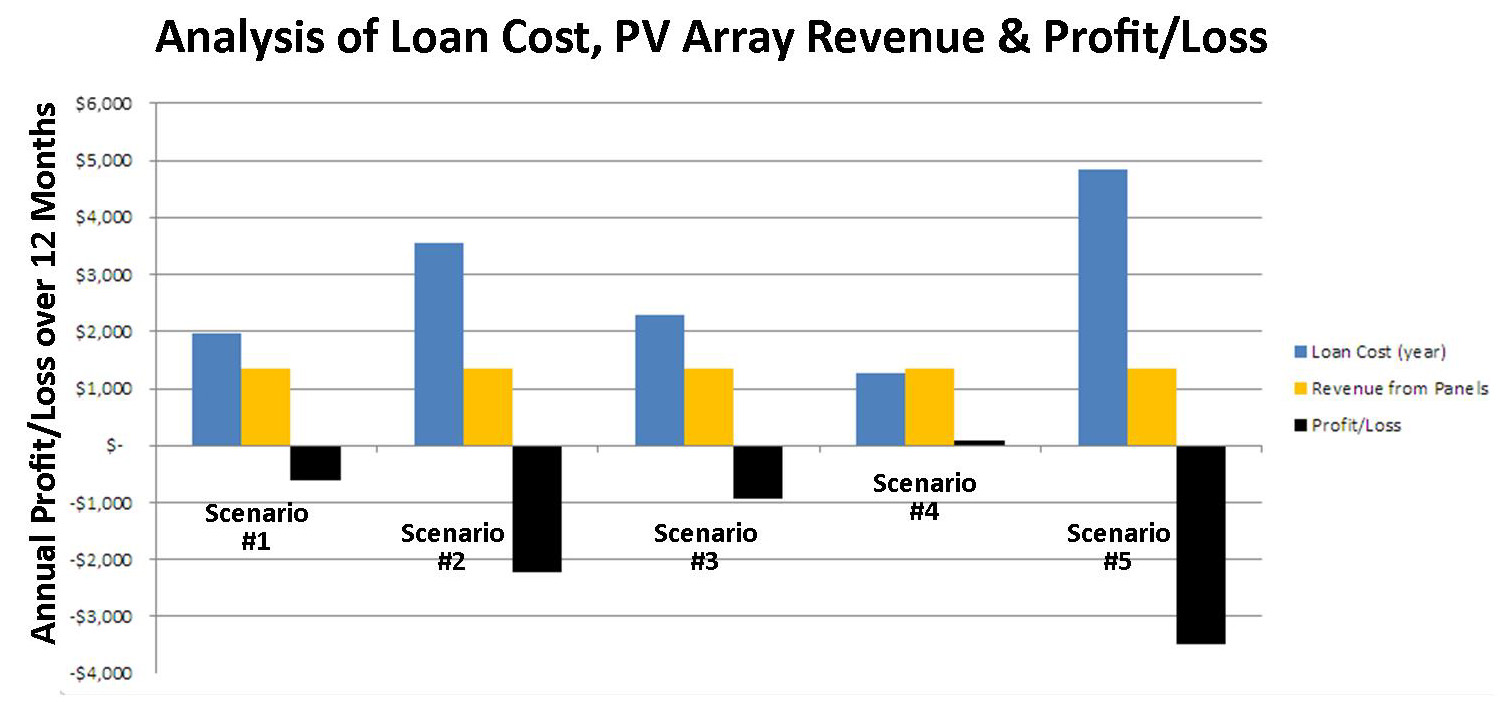

Does it make financial sense? Five cost scenarios are examined

I determined that a professionally installed 11 kWh PV array system would cost about $28,000. I don’t have that kind of cash — I would have to borrow the money. (If I had the cash, I would still use the same interest rate, as an “investment opportunity lost” factor). I came up with five scenarios.

- $28,000 borrowed at 5.0 per cent, amortized over the 25-year life expectancy of the system.

- $28,000 borrowed at 5.0 per cent, amortized over 10 years.

- The impact of a 30 per cent installation grant, similar to what Alberta introduced this past August, with a 10-year amortization.

- The impact of a 30 per cent installation grant with a 25-year amortization.

- A $38,000 loan to include a $10,000 storage battery for surplus power, with a 25-year amortization.

A full year cost/revenue analysis indicates that without a PV solar array installation grant, there is little financial incentive

(graphic: John Bleasby)

A money-losing proposition

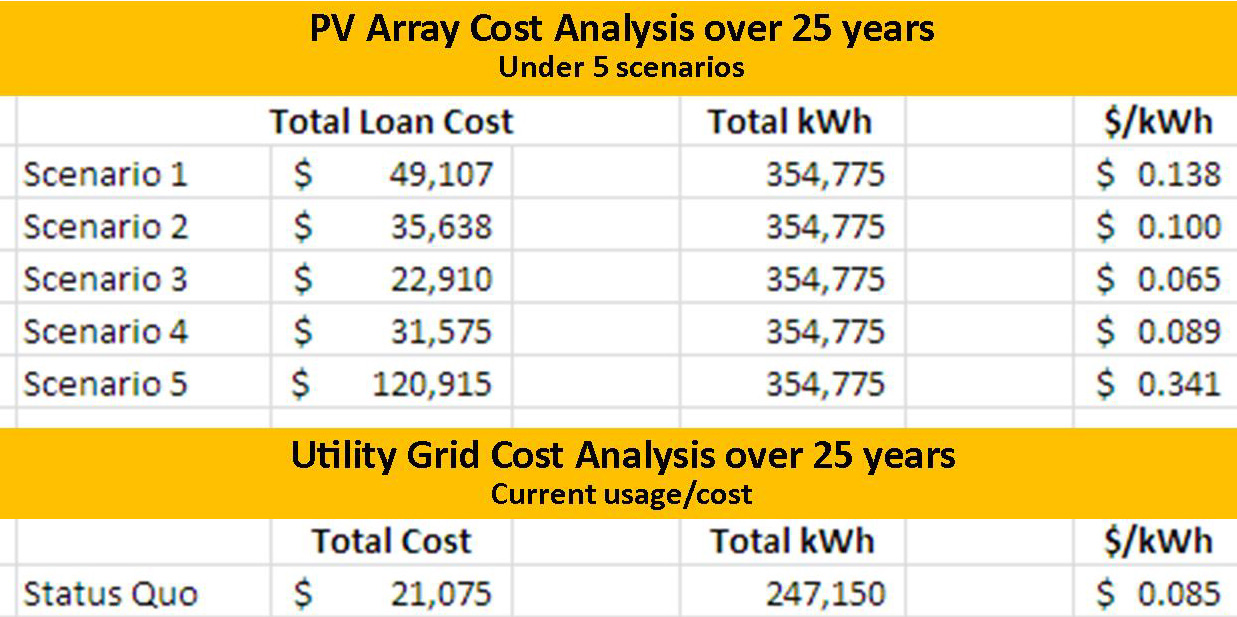

From a financial standpoint, I’ve concluded that it doesn’t make much sense for me to invest in a PV array. In four out of five scenarios, I lose money on an annual basis, not even including any maintenance costs. Over a 25 year period, my cost per kWh would be less if I bought power from the grid in four out of five scenarios.

An analysis of the total power generated by a PV array, total costs of loan repayment, and resultant cost per kWh, compared to continuing to buy power off the grid over a 25 year period. The grid appears to be less expensive, all capital costs and risks considered (chart: John Bleasby)

Many factors cloud residential solar’s future

Of course, my conclusion is based on current grid and PV array costs. In order to favor a PV array on my home, many things would have to happen: installation grants must be at least 30 per cent, special financing would have to be available, grid electricity prices would have to increase steadily, and the cost of solar arrays and storage battery systems must come down. Some of these are possible, others unlikely.

As a result, the strong financial argument for achieving full Net Zero Energy using PV solar arrays on homes which was so effective for so long, doesn’t look so compelling going forward. It ultimately might come down to the dollar-and-cents value each homeowner puts on their environmental concerns.

Read more about the “3 Columns of Support for NZE”

Part One: Sealing the Envelope

Part Two: Change is the Air; developing an IAQ strategy

Part Three: Air management Q’s & A’s

Got feedback? Make your opinion count by using the comment section below,

or by sending an email to:

JBleasby@canadiancontractor.ca

Follow John on Instagram and on Twitter for notifications about his latest posts

![]()

Advertisement

Print this page

Hi John, thanks for the research you had done on the PV’s.

First the sun neither rises nor sets, it circles above, great light to maintain the sane and insane humans alive amazing but true.

In 2013 my conclusion was more or less the same, about this insane power supply, wind mills also aren’t to far off in the same propaganda.

Apparently this was the way the Liberals find to indebt those agree to install these none sense apparatus. Any good electrical engineer or electrical tech will tell these power supply stations are just garbage.

Can’t be understood the Ontario fire association allowed a lot of these PV’s be installed over home roofs, its just plan fire azzard.

The best the Liberals had done so far, was indebt the Ontario people, selling propaganda, lies, deceit, misleading, high fees for trades, and any other licenses.

The Liberals became the political disease in Ontario.

I my view the political circus will start soon , and in June, any of the present political parties getting elected will not fix anything.

The Ontario debt is around 450 billion, from 125 billion when the Liberals took over, 325 billion increase, is about 25 billion average per year with the Liberals in power. This tell all, the incapacity and none sense of this Ontario government. Its a political disaster approaching in next June, we are heading for a political collapse.

All parties may want to sale the same propaganda with different titles, color full promises, and corrupted math, they all want to look after themselves, in the cost of tax payers. If the public does not wake up nothing will change, these crooks will fell free like gangsters to make laws and impose on us, to set more sideways agencies to collect fees, in a form of tax, like trojan horse virus.

The wonder full power generators PV’s and Wind mills, The PV’s aren’t good all to produce power, in top of homes are pure fire and storm azzard. Are you still buying this none sense power debt ?

Windmills are so good, lol,,, they start braking apart, like the one in Chattam kent, southwest of Ontario, another farming azzard, for people and animals. The Liberals grab a lot of peoples wallets, and sold debt bank accounts, the wonders of debt magic sold by the liberal government to Ontarians.

La magic parrot, de lucca, try to elude the city of London Ontario, declaring 170 million for the supposed rapid train ha ha, with no decisive details on this project, nor is need it. The people of London Ontario didn’t buy it,,, cry baby for liberal votes, you look like a fool de lucca.

Typical from the Liberals, karma is coming after you liberals, for what you had done to this province. Thanks for the people of London Ontario, showed Liberals have no business in the city matters, never mind announcing something not even start in the environment analyses, that’s bullshit.

The liberal should be paying for all the economic damage they caused to this Province. Where is theirs Liability insurances, to cover for failure?

Are these License or unLicense to operate, just to screw things up? The PhD’s to screw things up, common core math 2 + 2 = 5 or 3 x 4 = 11 Liberal math.

Cry babies for votes cry.

Hello John,

First a couple of qualifiers – I’ve been in the solar business in Ontario for almost 40 years and have installed over 1,000 – most thermal solar systems. I’ve said from the beginning that solar electric (PV) systems are barely green – since they are displacing “fairly clean” Ontario hydro power. (90+% of Ontario’s electricity comes from non-CO2 emitting generators – Nuclear & Hydro)

So, your article contains a number of mistakes. You pay per-kilowatt hour charges for; delivery, administration (and if a commercial property debt retirement) that add another 4 to 5 cents per kilowatt hour the time-of-use cost. So your average cost per kilowatt is going to be between 16 an 18 cents per kilowatt hour. EXCEPT – if you install a Net-metered PV system you automatically go onto flat-rate billing and now your average kilowatt hour cost is about 12 cents. BTW – don’t forget that you will also save the HST on the electricity you don’t have to buy. (that is another 1 – 2 cents per Khr saved….)

People who bought solar PV systems did not buying them because they are green – they bought them ONLY TO MAKE MONEY! The fact that they were sold as being “green” is because of the hordes of inexperienced solar companies that jumped into the market when the FIT (Feed In Tariff) program started in Ontario in 2009 needed to point to something other than greed to sell the systems. (600+ solar companies in 2009 now down to less than 40 – and shrinking fast)

Despite the claims of the solar PV industry, they had NOTHING to do with the shut down of the coal-fired electric plants in Ontario – that’s exclusively due to energy conservation efforts and a shrinking manufacturing sector.

Back to your system. (By the way – did you actually talk to any solar companies when researching this article – it doesn’t look like it!)

You cannot install a system larger than 10 Kilowatts in Ontario if you are connected to the electrical grid. (some exceptions exist but are costly to explore) $28,000 is a real low-ball cost – did you remember to include the HST which you will have to pay?

Wise people don’t install PV systems so large that they generate more power than they can get credit for – you probably only need a 9 Kilowatt system, which will not create an annual surplus and cost less to install. BTW electric water heaters are much more efficient than almost every natural gas water heater out there. Are you confusing “more efficient” with “costs less to operate”?

You are correct in surmising that trying to store electric power for on-peak use is a waste of time. This is because net metered connected homes are not charged time of use rates – they are charged the same rate 24/7, actually dropping when you exceed 700 Kwh a month.

Your financial analysis is flawed for a number of reasons. First, the cost per Kwh amount saved is higher than you’ve allowed. Second, there is no allowance for the cost of electricity rising faster than the rate of inflation – which will happen again after 3 to 4 years. I think it’s also foolish to amortize anything over 10 years. Would you buy a medium priced car and finance it over 25 years?? Longer amortization = more cost = foolish. If you can’t afford to pay for it outright don’t buy it – I’ve always said this about PV systems. Homeowners can’t write-off the cost of home improvements the way businesses can. (Which is why so many farmers have PV systems – they can write of the cost of the PV system and the income it generates – a great deal for small businesses!)

Your table seems to imply that the only cost to be considered is the cost of the loan. I would suggest that the cost of the solar system $28,000 (+HST) must be part of the amortization amount. After 25 years sitting on a roof the PV system will have deteriorated and may need to be completely replaced. Maintenance can also be costly…

Solar in Ontario is dead. (for at least 5 years)

There will “never” be programs like the FIT program again in Ontario – no political party will go there again. Just look at the moronic politically-motivated comments already posted here. Solar thermal (heating) systems work well and can displace 10 times as much CO2 as a PV system for much less money – but – with natural gas being 50% cheaper now than 10 years ago – they are just not cost effective. This is true even for solar pool heating systems that cost $4,500 installed and displace 4 tonnes of CO2 a year.

Something else to point out. Net Zero Homes are already so energy efficient, almost any energy saving technology added to them is no longer cost effective – because there is so little energy to be saved….

If & when it ultimately comes down to what dollar value homeowners put on greenhouse gas mitigation – we’re all doomed. After speaking to tens of thousands of people over the past 40 years about solar and selling and also installing over 1,000 (very cost effective) solar systems – I can say with complete conviction that if a solar system doesn’t save money and pay for itself within 5 or 6 years, homeowners will not buy it. PV will never get that cheap – its cost has already started to plateau and there are real limits about how much can be added to the grid – take a look at the situation in Hawaii.

Solar, thermal or PV will not become a viable business or persistent technology in Ontario (or the rest of Canada) until it is required by the building code – similar to how specific levels of insulation are required in walls & roofs. I suspect that is at least decade away from happening – if ever.

Good morning SolarDad,

Thank you for taking the time to outline your thoughts regarding the economic viability of small scale residential solar installations. We seem to agree on most of the issues, but not all.

First of all, I stand by the way I calculated my numbers. I did not include any HST in any financial calculations because HST varies across the country based on the provincial rate applicable. Electricity rates themselves vary across the country too. As a result, I prefer to simply look at the kilowatt hours generated and used — it tells the story well enough. I did in fact call solar companies and used the average estimate for the installation on my house. You suggest a 9kWh system for my house versus an 11kWh system, but also say my 11kWh installation costs are too low. Let’s call that a wash, OK?

I used both a 10 year and 25 year amortization for the loan cost calculations. Many proponents of solar for new homes suggest the cost be added to the mortgage, which is usually 25 years. Those who borrow might easily consider a 10 year loan. You say, “If you can’t afford to pay for it outright don’t buy it.” For those who do, they must consider the investment opportunity cost of paying cash. Not much to argue here. I also did not include any maintenance or efficiency deterioration factors. They both obviously have negative implications on viability, however any estimates made could be disputed. Instead, I thought it best to keep things as cheerful as possible for solar.

I disagree that electricity costs will always go up. I watch the wholesale electricity costs as determined by prices paid by utilities at auction, see them dropping dramatically, and as a result come away unconvinced that there is a forever upward trajectory. There is a glut of electricity generation in North America; the rules of supply and demand will ultimately govern.

I simply sought to ask the question about solar’s future, however you have pronounced the “Solar in Ontario is dead. (for at least 5 years)”. That might be so. Most homeowners looking at PV arrays will be motivated by the potential for financial gain. However, that potential gain cannot exist without government intervention. As public finding of small scale residential solar all but disappears, the sector’s growth prospects appear cloudy. I think you and I can both agree on that.

John

Hello John,

Thank you for your response. I recognize the conundrum of writing an article for a magazine that is distributed nationally – trying to make a general case work in jurisdictions that have widely varying utility arrangements. In Ontario, we have a public electric utility that operates Hydro and Nuclear stations. We have high electrical rates. Alberta, with largely private utilities usually have much lower electrical rates – for the moment.

Ontario’s solar program paid solar generators for the electricity they produced & sold to the public utility. Alberta currently only subsidizes the cost of the solar equipment and pays nothing for the electricity.

There is a short term “glut” of electrical generation in some regions of North America. We don’t have a national electrical grid, let alone international grid. This means regional surpluses are not easily shared with areas that have shortages. It also takes decades to build conventional electrical generation plants – and old plants wear out and do need to be replaced – and they are always more expensive than their predecessors. Like it or not electricity is going to continue to get more expensive – and solar alone is not the answer, because electrical energy storage of a scale to make it possible to run a grid is horrendously expensive and really does not exist yet (despite Musk’s assertions).

More and more energy consumption is going electric – so demand is going to start growing again. Transportation (trains & cars) are going electric and will consume more electricity than is currently being generated. A large amount of the “easy” electrical energy conservation measures has been done. Now the tougher, more expensive electrical conservation measures are left to complete – and that will happen slower, so the savings are going to diminish and the consumption will catch up.

Solar will not become a significant component of the energy supply until building codes mandate its inclusion in new construction and renovations. Many jurisdictions around the world have done this – but it may take years – decades – for it to happen in Canada in any meaningful way.

Solar does need to be part of the energy mix, and it could grow to be a significant part if supported properly. I don’t think this will happen any time soon in Canada. Too much petro-power influence in the political circles….

Hi again, SolarDad,

I won’t take issue with anything you write in your recent response (to my response). I simply remind you and other readers that I was investigating and commenting on ‘Small Scale Residential Solar’, as the title suggested.

Thanks for your continued interest and feedback. JB

Hi Solar Dad, Bravo bravo, to much elaborating writing to come to the same conclusion at the end what others have found out.

Solar PV’s cest um grand mierd, not only solar PV’s are dead in Ontario, but also soon will be the liberal party, will be gone into the shadows of history. They are apparently very good to sale debt and lies to their voters.

Why home owners choose to installed PV’s on their properties couldn’t pass 10kw, if they were connected to the grid? They should have been allowed to installed enough to supply their homes, or be able to sale what ever left in kwh to the grid too. This was a apparently design to in debt people, those chose to installed these PV’s.

It was to save our planet of CO2, what a bs.

The CO2 is another fraud, started with the crook Canadian oil business man called Maurice Strong, there is no global warming at all, real statistics don’t lie, all data to create the fraud global worming was manipulated. CO 2 is a noble gas not a pollutant, ( check green houses what levels are inside ) Our politicians got it all wrong and were fooled by manipulation; and start the PV’s solar energy and the wind mills, in the time Ontario have an enormous energy plus; due the close down of a lot of factories. Our politicians apparently new that, but instead allowed this crappy power generators to be in place, the grate power elusion.

Ontario was not in need of this garbage energy power, these are environmental dangers, fire dangers, health dangers and so on.

Our politicians apparently are crooks, Solar dad, don’t blame those which criticize the politicians, what they have been doing so far is insane in every front. Now, you and I and all the others soon will start to pay for some fraudulent tax called CO2. I only wonder what kind of new tax these insane politicians will came up with.

Nothing in development of a Nation/Province/City can go with out them, and their insane bill/laws/ bylaws, etc,. They are directly responsible for all the mess we are in. So they should be liable like so many of us in business, with insurances, Licenses, permits, and academic fit to operate. Any Joe blow can go to politics and vote for bills/laws/bylaws, with out any knowledge what they are doing, what will be the pros and cons of what they voted for.

Politics became a career for many also attractive way to be retired soon, with out liability or accountability of any shape or form.

I think by now you should have found out our politicians are a disaster for tax payers, Solar dad.

Wow some interesting responses to this article for sure. Now for my own experience. We installed a 10kw system under micro fit. Our costs were about $38,000 up and running. We get about 39.5 cents per kw generated. We had the money but decided to borrowed the money instead to do this and set up a separate company for it. That way we can write off the interest and such. It will take about 8-9 years to pay off that loan. After that until year 20 it is all our money. Not a lot maybe but it is all ours. Works out better them some of our investments that we trust an investment advise to help guide us, go figure. The only work we do for it is some accounting, my wife’s task and after every snow fall I will go up and clear off the snow so we generate all year round. This was our choice and it had nothing to do with being green, all about making some additional money. Friends of ours are doing it now but will only be getting about 20 cents per kw. But installation will also cost much less.

Hi Marten,

The only reason your private solar system can work and make you money is because it is connected to and is backed up by a publicly owned electric utility. This is a classic case of the 1% making money by exploiting the other 99%. The FIT and MicroFIT program was just a stealthy way of privatizing a public utility. Large international investment companies love it and have bought up most of Ontario’s large solar PV & wind projects.

Not your fault – the politicians created the opportunity – you just took advantage of it. But it doesn’t supply you energy security, (doesn’t work during power outages), it doesn’t supply your home with power (you sell everything it generates), it doesn’t reduce greenhouse gases significantly and it can complicate the operation of the electrical grid. It just makes you money by raising the cost of electricity (by only a little bit) for everybody else.

BTW, the last year of the MicroFIT program paid 28.2 cents per Kwh. The program is now closed – no new applications will be approved. Net metered PV systems will SAVE (not pay) about 12 cents per Kwh.